Form 8621 PFIC Reporting: Webinar with Steven Flynn

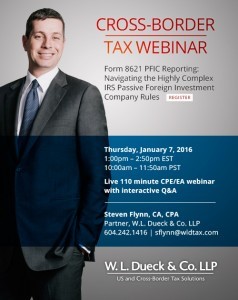

On Thursday, January 7, 2016, join Steven Flynn and a panel of cross-border tax specialists for a live webinar designed for tax advisers who deal with passive foreign investment company (PFIC) reporting.

This program is eligible for 2.0 Continuing Professional Education credits and the learning objectives are described as follows:

After completing this course, you will be able to identify those investment holdings that require reporting as a PFIC on IRS Form 8621. You will have a detailed understanding of the elections available to minimize the impact of PFIC holdings on filing, you will know the specific requirements for making the elections, and you will be able to discuss the tax impacts of those elections. You will also know what a properly completed Form 8621 should look like.

Click on the thumbnail below for details and registration information.