- Home

- Press Room

Press Room

Share

LinkedIn

X

Facebook

WhatsApp

Skype

Email

Print

Namir Hallak writes an article for Maple Business Council

Namir Hallak

06/16/2023

Our Partner, Namir Hallak, has written an article for Maple Business Council titled ‘Expanding Your Canadian Business to the U.S. : Cross-Border Tax‘ Expanding your Canadian business to the United States unveils an exciting growth opportunity that requires a well-planned roadmap. This article aims to ...

Read More »

Steven Flynn quoted in The Globe and Mail on IRS funding and its effects on U.S. and Canada

Andersen

08/26/2022

Our Partner, Steven Flynn, has been featured in an article by The Globe and Mail, titled, ‘IRS funding boost could result in ‘greater crackdown’ on taxes for U.S. citizens abroad’ Joe Biden’s administration was successful to pass the Inflation Reduction Act – said to be ‘a much different-looking ...

Read More »

Steven Flynn quoted in The Globe and Mail on Renunciation of U.S. Citizenship for Tax Purposes

Andersen

06/21/2022

An increasing number of Americans are looking to give up their U.S. citizenship, the decision isn’t just about national identity but also to reduce complexity of personal financial affairs and costs of complying with U.S. tax law. There are immigration and significant tax issues that ...

Read More »

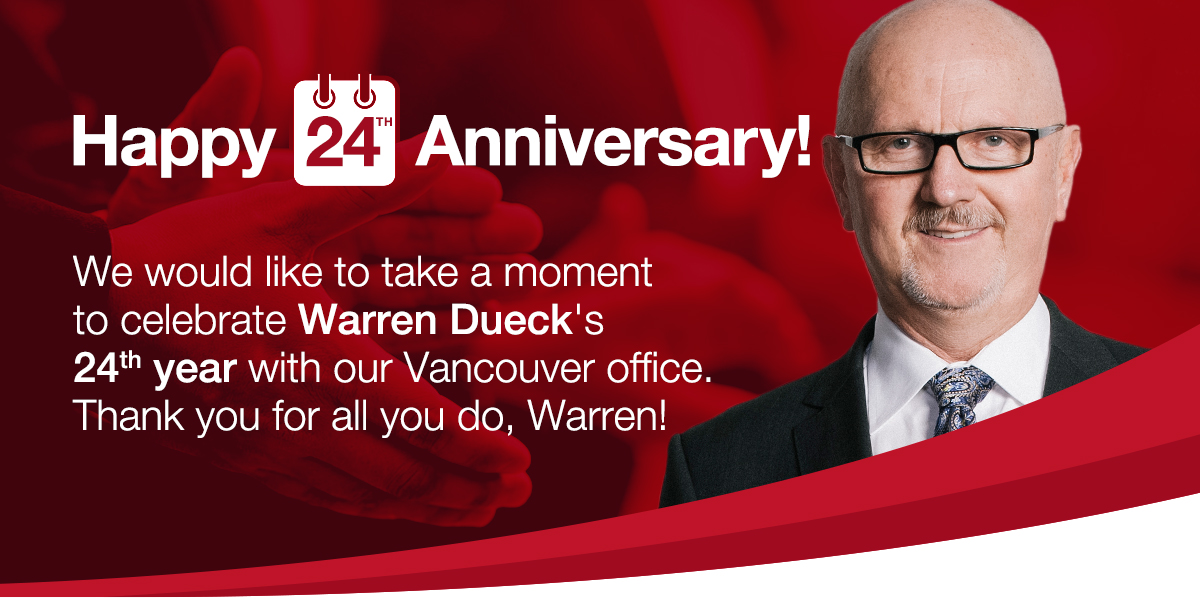

Warren Dueck Celebrates 24 Years with Andersen LLP

Andersen

03/04/2022

Entrepreneur. Visionary. Expert tax strategist. Consummate professional. Renaissance man. All are ways to describe our partner, Warren Dueck. This week Warren marked 24 exciting and successful years with our firm. He built the business providing bespoke cross-border tax services initially from his kitchen table and ...

Read More »

Krista Rabidoux to be ECPAC Spotlight Speaker on U.S. Tax Implications for Clients

Andersen

12/14/2021

Jan 19, 2022, Andersen LLP partner Krista Rabidoux will be the ECPAC spotlight speaker for a discussion on U.S. tax implications for your clients.

Read More »

Steven Flynn Quoted in The Globe and Mail on Tax Implications of Having an Executor or Beneficiaries Outside Canada.

Andersen

10/08/2021